How Much Is Missouri Personal Property Tax . How missouri property taxes work. The tax amount is determined based on the assessed value of the property, which is typically conducted by local assessors. How do i find out about my personal property taxes? Taxes on residential real estate in missouri are due by dec. Contact your county assessor's office. The assessor determines the market. The following calculators can assist you with the calculating the 2024 property tax rate or revised 2023 property tax rate, if necessary. Taxes paid after that date are subject to a 10% penalty. Questions pertaining to personal property assessments. How much is the tax amount that i owe? For contact information, see the missouri state tax. The personal property department collects taxes on all motorized vehicles, boats, recreational vehicles, motorcycles, and business property.

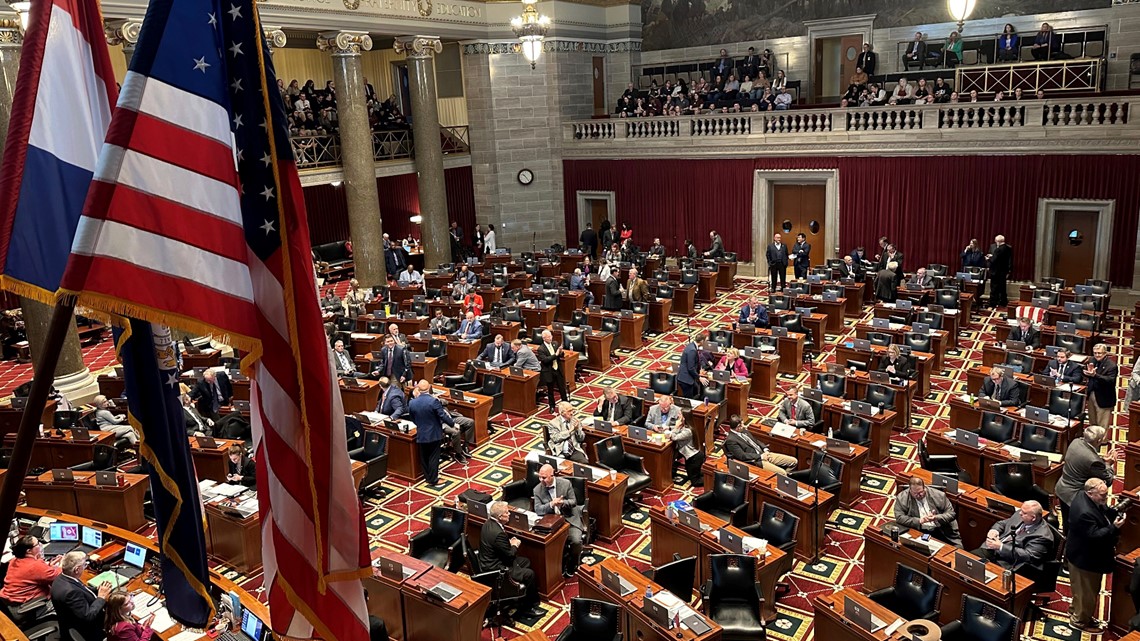

from www.ksdk.com

For contact information, see the missouri state tax. Taxes paid after that date are subject to a 10% penalty. The personal property department collects taxes on all motorized vehicles, boats, recreational vehicles, motorcycles, and business property. Contact your county assessor's office. Taxes on residential real estate in missouri are due by dec. The following calculators can assist you with the calculating the 2024 property tax rate or revised 2023 property tax rate, if necessary. Questions pertaining to personal property assessments. The tax amount is determined based on the assessed value of the property, which is typically conducted by local assessors. How much is the tax amount that i owe? How do i find out about my personal property taxes?

Missouri House passes bill cutting personal property taxes

How Much Is Missouri Personal Property Tax Contact your county assessor's office. Taxes on residential real estate in missouri are due by dec. The assessor determines the market. The tax amount is determined based on the assessed value of the property, which is typically conducted by local assessors. The personal property department collects taxes on all motorized vehicles, boats, recreational vehicles, motorcycles, and business property. Taxes paid after that date are subject to a 10% penalty. How missouri property taxes work. Questions pertaining to personal property assessments. How do i find out about my personal property taxes? The following calculators can assist you with the calculating the 2024 property tax rate or revised 2023 property tax rate, if necessary. Contact your county assessor's office. For contact information, see the missouri state tax. How much is the tax amount that i owe?

From tutore.org

Print Personal Property Tax Receipt St Louis County How Much Is Missouri Personal Property Tax Taxes paid after that date are subject to a 10% penalty. The assessor determines the market. Taxes on residential real estate in missouri are due by dec. The personal property department collects taxes on all motorized vehicles, boats, recreational vehicles, motorcycles, and business property. How much is the tax amount that i owe? How do i find out about my. How Much Is Missouri Personal Property Tax.

From prorfety.blogspot.com

Personal Property Tax Receipt Kansas City Missouri PRORFETY How Much Is Missouri Personal Property Tax The tax amount is determined based on the assessed value of the property, which is typically conducted by local assessors. Contact your county assessor's office. The assessor determines the market. How much is the tax amount that i owe? Taxes on residential real estate in missouri are due by dec. The personal property department collects taxes on all motorized vehicles,. How Much Is Missouri Personal Property Tax.

From www.formsbank.com

Fillable Form MoPts Property Tax Credit 2008 printable pdf download How Much Is Missouri Personal Property Tax Taxes on residential real estate in missouri are due by dec. Taxes paid after that date are subject to a 10% penalty. How much is the tax amount that i owe? The tax amount is determined based on the assessed value of the property, which is typically conducted by local assessors. How missouri property taxes work. For contact information, see. How Much Is Missouri Personal Property Tax.

From propertytaxgov.com

Property Tax St. Louis 2023 How Much Is Missouri Personal Property Tax How much is the tax amount that i owe? Taxes on residential real estate in missouri are due by dec. The tax amount is determined based on the assessed value of the property, which is typically conducted by local assessors. The personal property department collects taxes on all motorized vehicles, boats, recreational vehicles, motorcycles, and business property. The following calculators. How Much Is Missouri Personal Property Tax.

From www.sccmo.org

Personal Property St Charles County, MO Official Website How Much Is Missouri Personal Property Tax Questions pertaining to personal property assessments. Contact your county assessor's office. The tax amount is determined based on the assessed value of the property, which is typically conducted by local assessors. For contact information, see the missouri state tax. How much is the tax amount that i owe? How missouri property taxes work. How do i find out about my. How Much Is Missouri Personal Property Tax.

From woproferty.blogspot.com

How Do I Print My Personal Property Tax Receipt In Missouri WOPROFERTY How Much Is Missouri Personal Property Tax How much is the tax amount that i owe? Taxes paid after that date are subject to a 10% penalty. Questions pertaining to personal property assessments. How do i find out about my personal property taxes? The personal property department collects taxes on all motorized vehicles, boats, recreational vehicles, motorcycles, and business property. The tax amount is determined based on. How Much Is Missouri Personal Property Tax.

From www.taxuni.com

Missouri Personal Property Taxes How Much Is Missouri Personal Property Tax The following calculators can assist you with the calculating the 2024 property tax rate or revised 2023 property tax rate, if necessary. The tax amount is determined based on the assessed value of the property, which is typically conducted by local assessors. Questions pertaining to personal property assessments. Taxes on residential real estate in missouri are due by dec. Contact. How Much Is Missouri Personal Property Tax.

From www.countyforms.com

Fillable Business Personal Property Tax Return Form Printable Pdf How Much Is Missouri Personal Property Tax Taxes on residential real estate in missouri are due by dec. The assessor determines the market. Questions pertaining to personal property assessments. Contact your county assessor's office. The following calculators can assist you with the calculating the 2024 property tax rate or revised 2023 property tax rate, if necessary. How much is the tax amount that i owe? The tax. How Much Is Missouri Personal Property Tax.

From www.countyforms.com

Maricopa County Personal Property Tax Form How Much Is Missouri Personal Property Tax Contact your county assessor's office. How missouri property taxes work. The following calculators can assist you with the calculating the 2024 property tax rate or revised 2023 property tax rate, if necessary. The personal property department collects taxes on all motorized vehicles, boats, recreational vehicles, motorcycles, and business property. The tax amount is determined based on the assessed value of. How Much Is Missouri Personal Property Tax.

From www.signnow.com

5060 Form Complete with ease airSlate SignNow How Much Is Missouri Personal Property Tax Questions pertaining to personal property assessments. Contact your county assessor's office. Taxes paid after that date are subject to a 10% penalty. How do i find out about my personal property taxes? The assessor determines the market. Taxes on residential real estate in missouri are due by dec. For contact information, see the missouri state tax. The personal property department. How Much Is Missouri Personal Property Tax.

From www.formsbank.com

Form MoPtc Missouri Book Property Tax Credit Claim 2011 printable How Much Is Missouri Personal Property Tax How missouri property taxes work. How do i find out about my personal property taxes? The following calculators can assist you with the calculating the 2024 property tax rate or revised 2023 property tax rate, if necessary. The assessor determines the market. The personal property department collects taxes on all motorized vehicles, boats, recreational vehicles, motorcycles, and business property. Taxes. How Much Is Missouri Personal Property Tax.

From www.claycountymo.tax

How to Use the Property Tax Portal Clay County Missouri Tax How Much Is Missouri Personal Property Tax Contact your county assessor's office. The following calculators can assist you with the calculating the 2024 property tax rate or revised 2023 property tax rate, if necessary. For contact information, see the missouri state tax. Questions pertaining to personal property assessments. Taxes on residential real estate in missouri are due by dec. How do i find out about my personal. How Much Is Missouri Personal Property Tax.

From dallasbrhodie.pages.dev

Individual Tax Rates 202425 Lanny Modesty How Much Is Missouri Personal Property Tax How missouri property taxes work. How do i find out about my personal property taxes? The assessor determines the market. How much is the tax amount that i owe? Taxes paid after that date are subject to a 10% penalty. The personal property department collects taxes on all motorized vehicles, boats, recreational vehicles, motorcycles, and business property. Contact your county. How Much Is Missouri Personal Property Tax.

From www.formsbank.com

Form Mo1040p Missouri Individual Tax Return And Property Tax How Much Is Missouri Personal Property Tax The personal property department collects taxes on all motorized vehicles, boats, recreational vehicles, motorcycles, and business property. How do i find out about my personal property taxes? Taxes paid after that date are subject to a 10% penalty. The assessor determines the market. How much is the tax amount that i owe? How missouri property taxes work. Questions pertaining to. How Much Is Missouri Personal Property Tax.

From www.youtube.com

Missouri personal property tax jumps lead to questions YouTube How Much Is Missouri Personal Property Tax Taxes paid after that date are subject to a 10% penalty. Questions pertaining to personal property assessments. How do i find out about my personal property taxes? The assessor determines the market. The tax amount is determined based on the assessed value of the property, which is typically conducted by local assessors. For contact information, see the missouri state tax.. How Much Is Missouri Personal Property Tax.

From david-tua-mgd.blogspot.com

st louis county personal property tax waiver Ellan Eddy How Much Is Missouri Personal Property Tax Contact your county assessor's office. How missouri property taxes work. The tax amount is determined based on the assessed value of the property, which is typically conducted by local assessors. For contact information, see the missouri state tax. How much is the tax amount that i owe? Questions pertaining to personal property assessments. Taxes paid after that date are subject. How Much Is Missouri Personal Property Tax.

From www.formsbank.com

Form MoPts Property Tax Credit Chart 2011 printable pdf download How Much Is Missouri Personal Property Tax Contact your county assessor's office. How missouri property taxes work. The tax amount is determined based on the assessed value of the property, which is typically conducted by local assessors. Questions pertaining to personal property assessments. How do i find out about my personal property taxes? Taxes on residential real estate in missouri are due by dec. For contact information,. How Much Is Missouri Personal Property Tax.

From www.formsbank.com

Fillable Form MoPts Property Tax Credit 2013 printable pdf download How Much Is Missouri Personal Property Tax How do i find out about my personal property taxes? Contact your county assessor's office. For contact information, see the missouri state tax. The assessor determines the market. How missouri property taxes work. Questions pertaining to personal property assessments. The following calculators can assist you with the calculating the 2024 property tax rate or revised 2023 property tax rate, if. How Much Is Missouri Personal Property Tax.